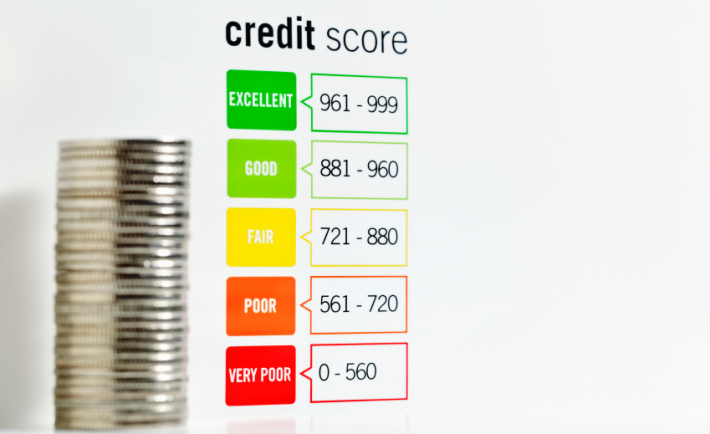

Maximize Your Credit Score

Did you know that 35% of your credit score comes from credit card use! That’s right, so if you don’t have credit cards or you do but don’t understand the “rules” to maximize your score, then check this out!

Help raise your credit score with this lesson.

Here are 7 rules that will help you increase & maintain an excellent credit score:

- Have no more than 3 to 5 cards (preferably not dept. store cards).

- Should have at least 4 years of history.

- Never open & close multiple cards — this will lower your score. If you need to close cards, close 1 every 3 months.

- Use each card every month if you can. Use the cards in place of cash or debit cards and then just pay cards with cash from bank account.

- Not using cards for several months will cause your score to drop – no credit use – no way to score you.

- Never charge above 25% of the limit at any time. If you do, pay it off or at least down to 25% ASAP!

- Carrying a balance month to month doesn’t improve your score – you can pay the cards off in full every month and avoid interest.

It is very IMPORTANT to make sure you have credit cards to BUILD your credit. If you’ve had problems with credit cards in the past and find it hard to get one now, we can recommend a few companies that help credit-challenged people, even those who have filed bankruptcy.

If you were instructed by your case manager to open one or more secure lines of credit and have not done so, please visit our resources page for different options.