Understanding Your Credit Report and Score

Every credit report is laid out differently and some are difficult to read, especially if you don’t know what you are looking for. In order to properly understand your credit report and credit score, you will need to know some basic information. We have quite a bit of data to interpret, and there are many factors that determine a good or bad credit score. A credit repair program may be a good option for you depending on what we find.

Identifying Information

Your credit report will list your name, address, Social Security number, date of birth, and employment information, which are used to identify you. You may have multiple versions of your name, especially if you are a married/divorced female who has changed her name a few times. This section will also show any nicknames and abbreviations of your name that might have been used in the past. Your past and present address(es) will be included as well. These factors are not used in credit scoring; however, you will want to make sure this information is completely accurate so you are not associated with someone else’s credit score. Updates to this information come from information you supply lenders.

Trade Lines

These are your credit accounts. Lenders report on each account that is established with them. They report the type of account, the date you opened the account, your credit limit, your loan amount, the account balance, and your payment history.

There are three different types of account classifications:

- Mortgage Accounts – These include first mortgages, home equity loans, and any other loans secured by real estate that you own.

- Revolving Accounts – Revolving accounts are charge accounts that have a credit limit and require a minimum payment each month. This includes most credit cards.

- Installment Accounts – Installment accounts are credit accounts in which the amount of the payment and the number of payments are predetermined or fixed, such as a car loan.

Credit Inquiries

When you apply for a loan, you authorize your lender to ask for a copy of your credit report. This is how inquiries appear on your credit report. The inquiries section contains a list of lenders who accessed your credit report within the last two years. Typically you will see a list of “voluntary” inquiries, spurred by your own requests for credit, followed by a list of “involuntary” inquiries. These result from creditors who order your report prior to sending you one of those “preapproved” offers for credit and don’t affect your credit rating.

Public Record and Collection Items

Credit reporting agencies also collect public record information from state and county courts and information on overdue debt from collection agencies. Public record information includes bankruptcies, foreclosures, suits, wage attachments, liens and judgments.

Satisfactory Accounts and Negative Items

All three of the major credit reporting agencies (TransUnion, Equifax, Experian) will segregate “positive” accounts from “negative” ones, thereby making the interpretation of your report a little easier. Some reports may give a “Credit Summary,” which provides a one-page, easy to review snapshot of all your open accounts, as well as some useful summary statistics, such as total debt by account type, debt-to-credit ratio by account type, and length of credit history.

In the section showing the negative items, these accounts will be listed showing when a late payment occurred and how late it was, the balance on these accounts, and if this account was a charge-off or went to a collection agency. It will usually have the address of the creditor and the account number listed as well.

Credit Report Formats and Codes

Each credit bureau uses different codes on their reports. These codes include payment history codes, public record codes, and trade check rating codes, and break down each section of the report. If there is anything on your credit report you do not understand, go to one of the links below and you will find out what all the codes mean.

- Experian Credit Report Format and Codes

- TransUnion Credit Report Format and Codes

- Equifax Credit Report Format and Codes

- Risk Factor Reason Codes

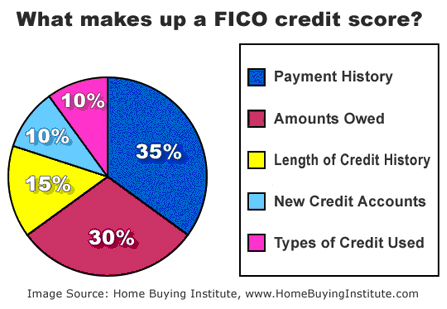

How is your Credit Score Determined?

Do you know what your credit score consists of? Or how this information is gathered?

Credit reports contain information about an individual’s background and credit history, and these reports are used to determine if someone is creditworthy. If you pay your mortgage late, file for a bankruptcy, or are denied a line of credit, all of these items will be recorded in your credit report.

Equifax, TransUnion, and Experian are the three major companies that compile credit information. These companies keep track of your addresses, lines of credit, payment history, checking accounts, and other similar information. They also list the balances you owe on these lines of credit. If you pay your bills on time, this will be reflected in the credit reports. However, if you are habitually late with your monthly payments, your payments go into collections, or you have a judgment against you from a lawsuit, this will also show on your credit report.

Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, employers, and government departments employ the same techniques. The information from your credit score will dictate the interest rate you will pay, deposits required, insurance rates, etc. Today, credit scores influence many aspects of everyday life.

In the United States, the key credit bureau consumer protections and general rules or governing guidelines for both the credit bureaus and data furnishers are the federal Fair Credit Reporting Act (FCRA), Fair and Accurate Credit Transactions Act (FACTA), Fair Credit Billing Act (FCBA), and Regulation B.