What is my TRUE Credit Score?

Why did my score change?

Why is it different with each credit bureau?

Why is it different online, at the car dealership, and the mortgage lender?

What is my TRUE credit score?

More and more, we hear about how important it is to “protect your credit score,” “improve your credit score,” and “find out your credit score for free!” By all accounts this growing chorus is making the average person more keenly interested than ever before in their credit score and how it works.

There’s just one problem with this new focus on the “almighty” credit score: in reality, we don’t have just one credit score. On the contrary, each of us actually has over 40 different credit scores!

Yes, you heard us right! And we agree with you, it’s ridiculous & confusing.

So remember, we’re just the messenger, but we will try to explain the best we can how this system works. There are two components of the system, scoring models and credit scores.

Scoring Models

First of all, there is a different scoring formula applied to the information on your credit report based on who wants to know your credit score.

For instance, if a potential employer wants to know your credit score, a different formula will be used than if a mortgage banker wants to know your credit score.

This is because the mortgage broker cares much more about your history on mortgage payments than a potential employer, who wants a more general picture of your financial trustworthiness.

So this “different scoring formula” also applies to:

- security clearances

- tenant screening

- auto loans

- furniture loans

- and so on…

And, it is different between ALL 3 credit bureaus as well.

Here’s an exact quote from Equifax:

Insurers may also look at your credit history, but typically not your numeric score, since they’re assessing risk, not creditworthiness. Insurance underwriters use the data that’s found in a credit history with one of the three bureaus to determine a consumer’s likelihood to file a claim.

And another thing that will affect your credit score is that not all creditors report to ALL 3 bureaus. Just so you know, there isn’t a law that says they have to.

While there are many different scoring models, the same principles for improving your credit score apply across the board. Far more important than the number itself is understanding what you need to do to make that number better. The scores may be different, but risk factors tend to be very consistent from one credit score to the next. So focusing on what’s in your reports could help you build your credit overall.

And don’t think you’re okay just because your online credit score comes in over 700. You still want to take the steps necessary to ensure that there is NO negative information on your credit report, so you can make sure your credit scores are the best they can be.

Because there are hundreds of credit scores that measure many different probabilities, consumers generally do not need to be overly concerned with the type of score or even their number. It’s also important to note that your credit score is a variable that can change every time your credit report changes. Removing derogatory remarks alone will not increase your credit score – it’s making sure you’re following the steps below.

Credit Scores

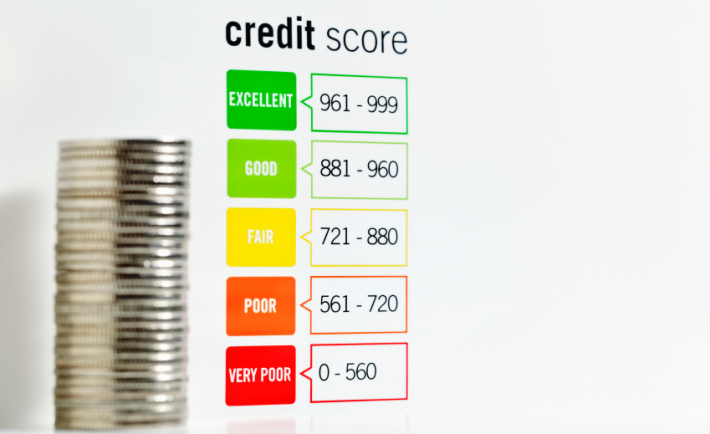

A credit score is a three-digit number used by financial institutions to evaluate your creditworthiness, or the likelihood that you’ll pay back your debts. When a consumer applies for a credit card, mortgage, student loan, auto loan or other line of credit, a lender usually pulls a credit score to help decide whether or not to extend credit.

There are six key credit-influencing factors that are commonly used in calculating your credit score, although the actual credit score number may differ depending on which credit bureau (Equifax, Experian or TransUnion) pulls the information and what kind of credit score model is used.

1. Open Credit Card Utilization: Your open credit card utilization rate is your available credit compared with how much you’re using at any given time. It can be calculated by taking your total open credit card balances and dividing that number by your total open credit card limits. The resulting percentage is your utilization rate. It’s important to note that your credit card utilization rate is not calculated by looking at the balance you carry over from month to month. It is calculated using the balance you have at the time that your credit card issuer reports to the credit bureau. Therefore, it is not necessary to carry over a balance from month to month. You could maintain a healthy credit card utilization rate through regular credit card use and paying off your balance every month. So, for the best scores, never use more than 25% of your limit, ever!

2. Percent of On-Time Payments: Your percentage of on-time payments represents how often you make payments on time. It’s often a heavily weighted factor in calculating a credit score, so just one or two late payments could significantly affect your score. Paying creditors on time is one of the best ways to keep up good credit health; it shows lenders and creditors that you’re reliable and will pay back your debts.

3. Number of Derogatory Marks: These include accounts in collections, bankruptcies, foreclosures, and liens. A derogatory remark on your credit report will severely impact your credit score in a negative way. Derogatory marks typically take seven to ten years to clear from credit history on their own. A derogatory mark could have a huge impact on your chances of getting approved for credit; it indicates to a lender that you may have significantly mismanaged credit in the past.

4. Average Age of Open Credit Lines: This factor averages the ages of your open credit cards, mortgages, auto loans, student loans and other lines of credit on your credit report. If your credit history is lengthy, lenders have more information to accurately assess creditworthiness. It’s also frequently an indication that you have been able to successfully manage your credit. For this reason, closing your oldest credit card account is typically ill-advised. It will shorten the average length of your open credit lines and reduce your available credit, possibly increasing your credit utilization rate. Think carefully about when you may want to close an old credit card account, and when you may want to avoid doing so.

5. Total Number of Accounts: This credit score factor totals up your number of credit cards, auto and student loans, mortgages and other lines of credit. Consumers with a higher number of credit accounts generally have better credit scores, since they’ve been approved for credit by more lenders. Also, having various types of credit – both revolving and installment – on your profile can positively contribute to your creditworthiness. However, it’s typically not recommended to open several new lines of credit simply to increase your total number of credit accounts. This factor of your credit score is usually weighed less heavily than the rest. If you are in the market to apply for new credit, make sure you first read reviews and research which product is right for you.

6. Total Hard Credit Inquiries: The final factor commonly used in your credit score is your total number of hard credit inquiries. Hard inquiries occur when a financial institution, such as a lender or credit card issuer, checks your credit in order to decide whether to approve you for a loan or credit card. A hard inquiry may occur when you apply for any of the following:

- Auto loan

- Student loan

- Business loan

- Personal loan

- Credit card

- Mortgage

One hard inquiry could negatively affect your credit score by a few points, but the effect typically will begin to lessen after a couple of months. Multiple hard inquiries generally will more significantly impact your credit score, and can communicate to lenders that you are desperate for credit or are unable to qualify for credit. For this reason, it’s a good idea to avoid applying for several lines of credit at once.

Conclusion: It’s important to know that while some of these factors are weighted more heavily than others, no one factor works independently of the others. Each one can contribute to your overall credit scores.

Finally, to answer the questions at the top:

- Why did my score change? For any number of reasons listed above.

- Why is it different with each credit bureau? Any number of reasons, including whether creditors report to each bureau.

- Why is it different online, at the car dealership, and the mortgage lender?

- Different scoring models, different risk assessment, etc. – see above.

- What is my TRUE credit score? There is no true credit score!

Remember, we offer a two-tiered approach:

- Credit Education: To educate you about what you have to do to increase your scores and maintain an excellent credit profile and scores.

- Credit Restoration: To dispute and try to remove as many derogatory remarks as possible.

If you implement our recommendations, your score WILL improve over time.

Disclaimer: All information above was accurate at the time of its initial publication. Efforts have been made to keep the content up-to-date and accurate. However, Capital Financial Solutions does not make any guarantees about the accuracy or completeness of the information provided.